Kaiser Health Plan Fiduciary Resources

Kaiser accrues $12.3 billion in liability to benefit for-profit medical groups

The Kaiser Foundation Health Plan (“Kaiser”) is a non-profit public benefit corporation. Its considerable assets are held strictly in trust for charitable purposes under California law. While Kaiser does contract with a variety of for-profit companies – most notably the Permanente Medical Groups – those subcontractors are distinct entities. Medical group profits and assets are not part of Kaiser’s financial statements.

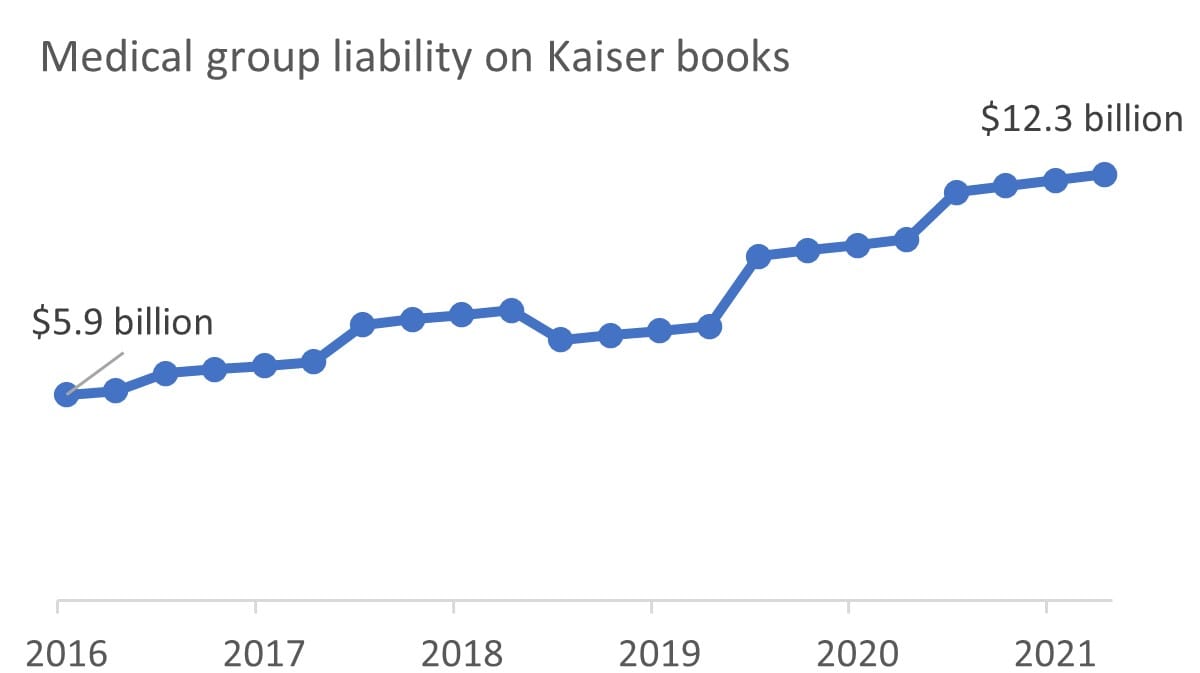

Nevertheless, in recent years, Kaiser’s balance sheet has accrued a growing liability associated with “retirement benefits provided for physicians associated with certain Medical Groups.” They explain that these benefits “are determined based on the length of service and level of compensation of each participant.” A review of physician benefit handbooks indicates that this retirement plan primarily benefits more senior physicians – namely, those who are disproportionately likely to hold a partnership or shareholder interest in their medical group.

These liabilities are substantial. As of June 30, 2021, they were $12.3 billion, or 25% of Kaiser’s total liabilities. That was up from $5.9 billion (16% of total liabilities) just five years earlier – a jump of 104%. Because the liability is connected to employment and compensation decisions made by the Medical Groups, Kaiser may not have full control over growth of this liability in the future.

In short, Kaiser has encumbered $12.3 billion of its assets on behalf of the senior employees and shareholders of distinct, for-profit companies. This equates to nearly $1,000 for every enrollee of the Kaiser Foundation Health Plan. It also amounts to about half what Kaiser pays annually to its medical groups in California and Hawaii.

Health plan fiduciaries should examine closely whether Kaiser’s trend assumptions in recent years have truly reflected their legitimate costs, or whether they have been inflated by inappropriate financial arrangements. Among the key questions they should ask:

- Is this liability consistent with the charitable purpose of the Kaiser Foundation Health Plan under California law?

- Have past rate increases been inflated to help fund these obligations, and what are the implications for future premiums?

- What consequences could it have for tax obligations of Kaiser and of the Medical Groups?

See below for additional resources on this topic.

|

Financial Statements |

Tax Filings |

Charitable Trusts |